Table of Contents

** Minutes

What is the Import One Stop Shop (IOSS)?

How to register for the Import One Stop Shop

Key benefits of using the IOSS for your ecommerce business

Most small business owners can agree that navigating taxes can be complicated. It’s one thing to remit and file taxes locally, but what if you want to start shipping to customers in the European Union (EU)?

Then you’ll need to consider international value-added tax (VAT) rules, import duties, and customs processes which can make it feel downright overwhelming.

However, the Import One Stop Shop (IOSS) simplifies VAT compliance, freeing ecommerce businesses to focus on growth rather than tax complexities. Combined with a trusted fulfillment partner like ShipBob, businesses can streamline logistics, stay compliant, and deliver a seamless experience to customers worldwide.

What is the Import One Stop Shop (IOSS)?

The Import One Stop Shop (IOSS) is a VAT collection system introduced by the EU in July 2021. It’s designed to simplify VAT reporting for ecommerce businesses selling low-value goods (valued at €150 or less) directly to customers in EU member states. Instead of requiring sellers to register for VAT in multiple EU countries, the IOSS allows them to report and remit VAT through a single IOSS registration.

Who is eligible for IOSS?

Eligibility for the IOSS depends on your business type and sales model. Here’s a breakdown:

- Non-EU sellers: Eligible to use the IOSS if they appoint an intermediary based in the EU (e.g. SimpleVAT) to handle VAT obligations on their behalf.

- EU-based sellers: Can register directly for the IOSS in their member state without the need for an intermediary.

- Online marketplaces: Platforms facilitating third-party sales (think Amazon) can register for the IOSS and remit VAT for eligible transactions.

The importance of IOSS for ecommerce businesses

The IOSS simplifies VAT collection for ecommerce sellers by allowing VAT to be charged at the point of sale. This is important for a few reasons:

- Streamlines customs clearance: By collecting VAT upfront, IOSS eliminates the need for customers to pay VAT upon delivery, speeding up customs clearance and aligning with modern ecommerce fulfillment practices.

- Improves customer satisfaction: No surprise VAT bills mean happier customers, reducing cart abandonment and fostering loyalty.

- Compliance confidence: Using IOSS ensures your business adheres to EU VAT regulations, minimizing the risk of fines or penalties.

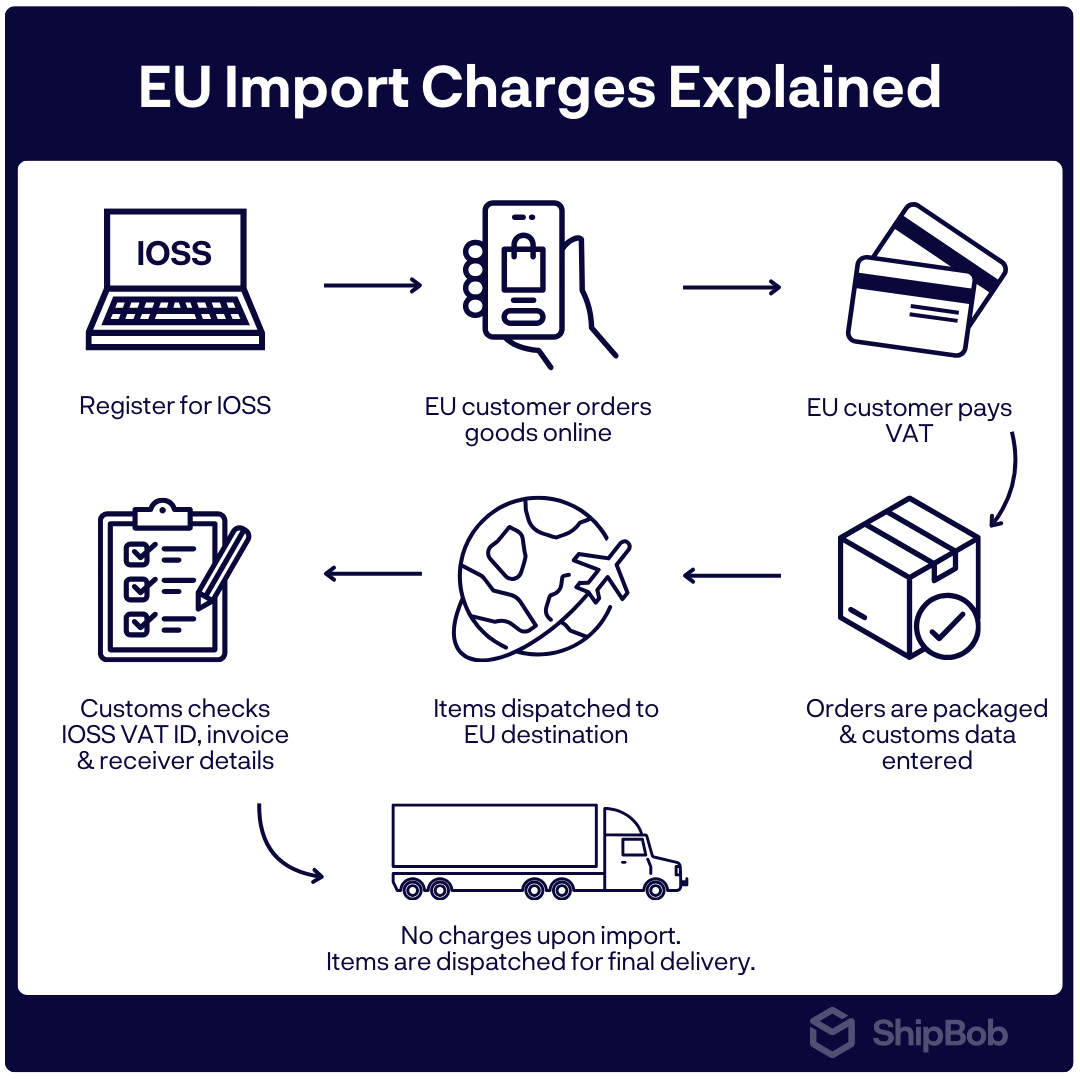

Below is an overview of the shipping process to EU customers under the IOSS scheme.

How to register for the Import One Stop Shop

Registering for the IOSS is a straightforward process with the help of your member state’s portal or an intermediary. Simply follow the steps, gather the required documentation, and integrate the system into your ecommerce operations.

Step-by-step guide to registering for IOSS

Below, we’ll outline the requirements and walk you through how to get started.

Step 1: Confirm your eligibility

Determine if your business qualifies for IOSS and ships items with an intrinsic value not exceeding €150.

Step 2: Gather required documentation

Prepare the necessary information, including:

- Business details (legal name, address, contact information).

- VAT identification number.

- Description of goods and operations.

Step 3: Register for IOSS

- EU-based sellers: Register directly in your country of establishment.

- Third-country sellers: Appoint an EU-based intermediary.

Step 4: Update your ecommerce system

Integrate the IOSS VAT collection process into your platform to ensure accurate payment of VAT at checkout:

- Automatically calculate and display VAT based on the customer’s location.

- Ensure your ecommerce and fulfillment systems process only IOSS-eligible orders under the scheme.

Step 5: Start collecting VAT at checkout

Once registered, begin collecting VAT at the point of sale for all eligible shipments to EU customers.

Step 6: Submit monthly VAT returns

File your IOSS return through your member state’s portal (or via your intermediary) by the end of each month for the previous month’s sales. This will include:

- Total VAT collected.

- Breakdown by EU member state.

Step 7: Maintain records

Implement robust record-keeping practices for all IOSS-eligible transactions. Keep these records for at least 10 years to ensure compliance during audits or inspections.

Key benefits of using the IOSS for your ecommerce business

The IOSS brings significant benefits for ecommerce sellers, making VAT compliance simpler and improving the overall efficiency of selling to EU customers.

Reduce VAT complexity and faster shipping times

The IOSS reduces VAT complexity by consolidating reporting and ensuring smoother customs clearance. Including the IOSS number in shipping documents ensures VAT-paid shipments are processed quickly, improving delivery times and customer satisfaction.

Increase customer satisfaction and competitive edge

Transparent pricing at checkout—without surprise VAT charges—enhances the shopping experience, building trust and reducing frustrations like delays or unexpected fees. Using the IOSS ensures a smoother, more enjoyable buying process.

How ShipBob’s supports global fulfillment compliance

ShipBob’s global network and technology-driven solutions make it easier for ecommerce brands to navigate IOSS compliance and grow internationally. By combining advanced logistics tools with services like DDP shipping, a 3PL like ShipBob ensures that duties and taxes are handled upfront, simplifying cross-border operations and improving the customer experience

Faster, VAT-compliant shipping with global fulfillment network

With over 50 global warehouse and fulfillment centers, ShipBob helps ecommerce businesses reduce shipping costs and delivery times. By leveraging the IOSS, ShipBob streamlines international shipping to ensure seamless VAT compliance with the European Commission for EU-bound orders.

Additionally, ShipBob’s integration of shipping labels optimized for global requirements further reduces errors, ensuring that packages move through customs and delivery networks efficiently.

Real-time visibility into inventory and VAT management

ShipBob’s platform offers real-time visibility into your inventory and orders, allowing you to monitor stock levels, track shipments, and manage shipping processes from a single, user-friendly dashboard. This transparency helps you stay on top of demand, prevent stockouts, and ensure accurate, timely order fulfillment.

Customizable fulfillment options to enhance the customer experience

ShipBob’s fulfillment services go beyond logistics by offering fully customizable options to elevate your brand. From custom packaging designs to personalized kitting and inserts, you can create a memorable unboxing experience for your customers. These tailored solutions allow you to maintain brand consistency and build stronger connections with your audience.

Don’t just take our word for it: international fulfillment success stories with ShipBob

ShipBob’s proven success in international fulfillment highlights its ability to handle the complexities of cross-border shipping.

For example, Our Place partnered with ShipBob to scale its operations beyond the U.S. and into Australia and Canada. By leveraging ShipBob’s fulfillment centers in these regions, Our Place was able to store inventory locally and fulfill orders efficiently, reducing shipping times and costs.

“In 2024, we should be shipping over 1 million parcels out of the ShipBob network. The global scale of ShipBob’s network allows us to go to multiple markets without taking on additional technology costs.”

Ali Shahid, COO of Our Place

Similarly, PetLab Co. partnered with ShipBob to fulfill orders from multiple sales channels and reach customers worldwide. By managing both DTC orders and B2B distribution for marketplaces like Chewy and Amazon, ShipBob simplified international logistics and supported PetLab’s omnichannel strategy, helping them expand globally and meet growing demand.

Get started with ShipBob

Ready to start shipping with ShipBob? Fill out the form to connect with our team and get a customized quote.

Import One Stop Shop FAQs

Here are answers to commonly asked questions about Import One Stop Shop.

Can non-EU sellers use the Import One Stop Shop (IOSS) for VAT?

Yes, non-EU sellers can use the IOSS, but they are required to appoint an EU-based intermediary who will handle VAT registration, reporting, and compliance on their behalf.

Who can benefit from the IOSS?

Any business selling low-value goods (valued at €150 or less) directly to customers in the EU can benefit from the IOSS. It simplifies VAT reporting, improves the customer experience, and streamlines cross-border shipping operations.

How does ShipBob help with IOSS compliance?

ShipBob helps businesses stay compliant with IOSS through its tech-driven platform and global fulfillment network. By allowing you to configure your IOSS number and enable DDP shipping directly in the ShipBob dashboard, ShipBob ensures that VAT is properly applied to EU-bound orders at checkout.

How can I find an intermediary for the Import One Stop Shop IOSS?

To find an intermediary, consult the EU tax authorities in any member state or look for specialized firms that offer intermediary services for VAT compliance.

Which types of goods are eligible for the IOSS scheme?

The IOSS applies to low-value consignments with a value of €150 or less (excluding shipping costs) sold directly to EU customers. However, items subject to excise duties like alcohol, tobacco, and perfumes are not included in this exemption.